UNDERSTANDING TITLE & ESCROW

What is Title Insurance?

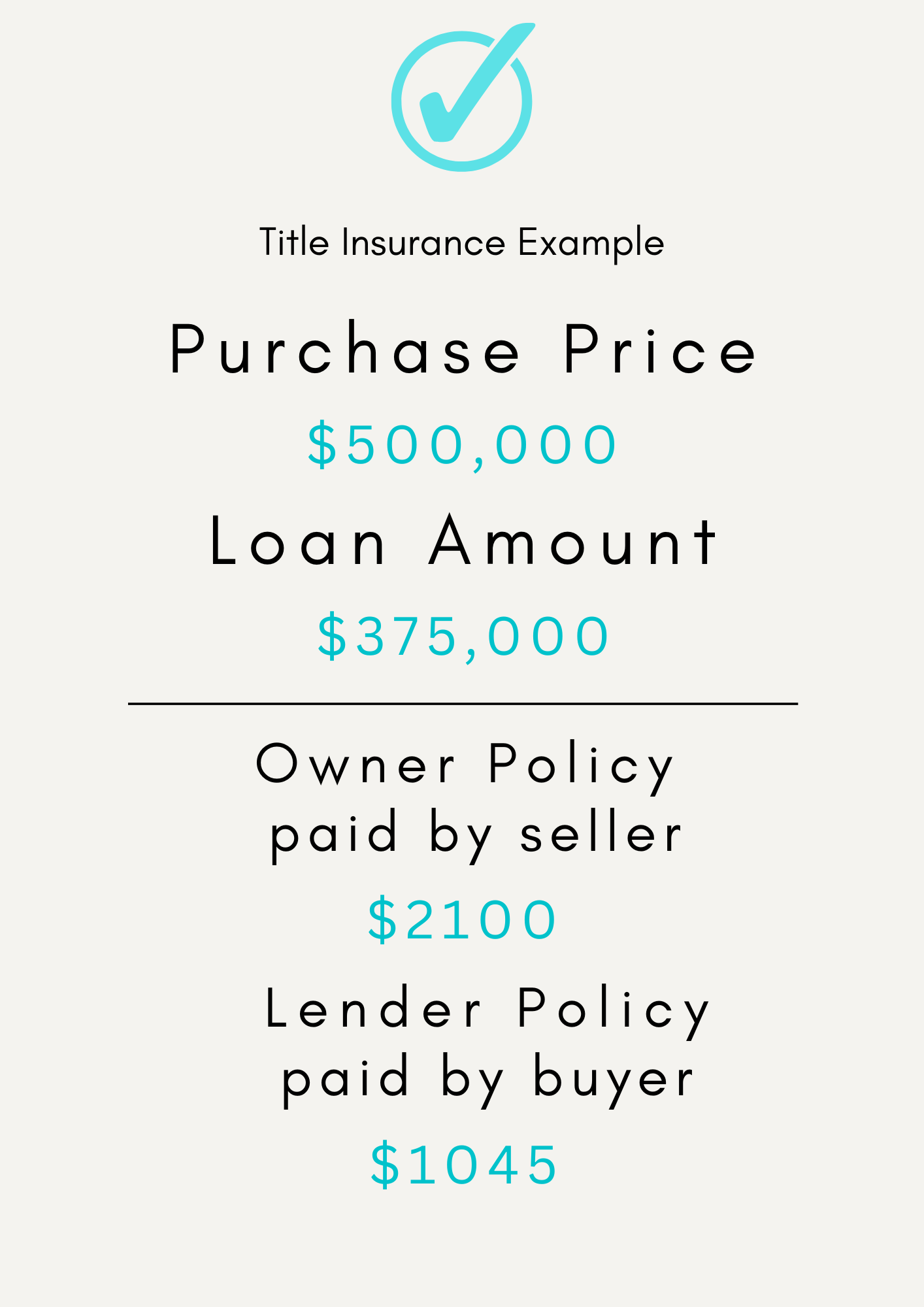

Title Insurance Costs

Title Insurance rates are set by state insurance commissions and are calculated based on the purchase price of your property (owner’s policy) and the loan amount (lender’s policy). For the purchaser of the home these are considered part of your closing costs and are paid to the title company once you bring in your final check based on the final settlement statement.

Closing

Signing and Finalizing the deal

Your Escrow officer at Clear Title Agency of Arizona will be in contact with you throughout the transaction collecting information from you to ensure the property people or entity are on the Deed once recorded with the county. They also communicate at a high level with your Real Estate Agent & Loan Officer to make sure they have all the proper documentation from them. Once the Lender and Title company have balanced the settlement statement, your escrow officer will schedule the loan document signing and let you know the amount needed from you to close or the amount due back to you after closing. Once you sign the loan documents and title/escrow company has collected all money from both the purchaser and the lender, they will release it to record with the county. Once the county has recorded the deed in the purchasers name, it officially becomes that persons property. They are now the happy owner of their new property! Their agent will schedule a time to meet them at the property to give them the keys to their new home.